More Powerful Pension Calculator

12. May 2025

LSR’s pension calculator for Division A has been updated, allowing fund members to now calculate the impact of taking half-pension benefits before transitioning to full pension. Members can also see how their pension entitlements develop if they choose to continue working while receiving full pension payments.

The LSR pension calculator is constantly evolving, and now two powerful new features have been added to help fund members visualize how their pension entitlements may develop.

Half-Pension:

Fund members can choose to take half pension payments from the age of 60. In this case, payments for half of their pension entitlements begin, while the other half is deferred and continues to grow according to contribution payments and LSR’s rules on pension deferral.

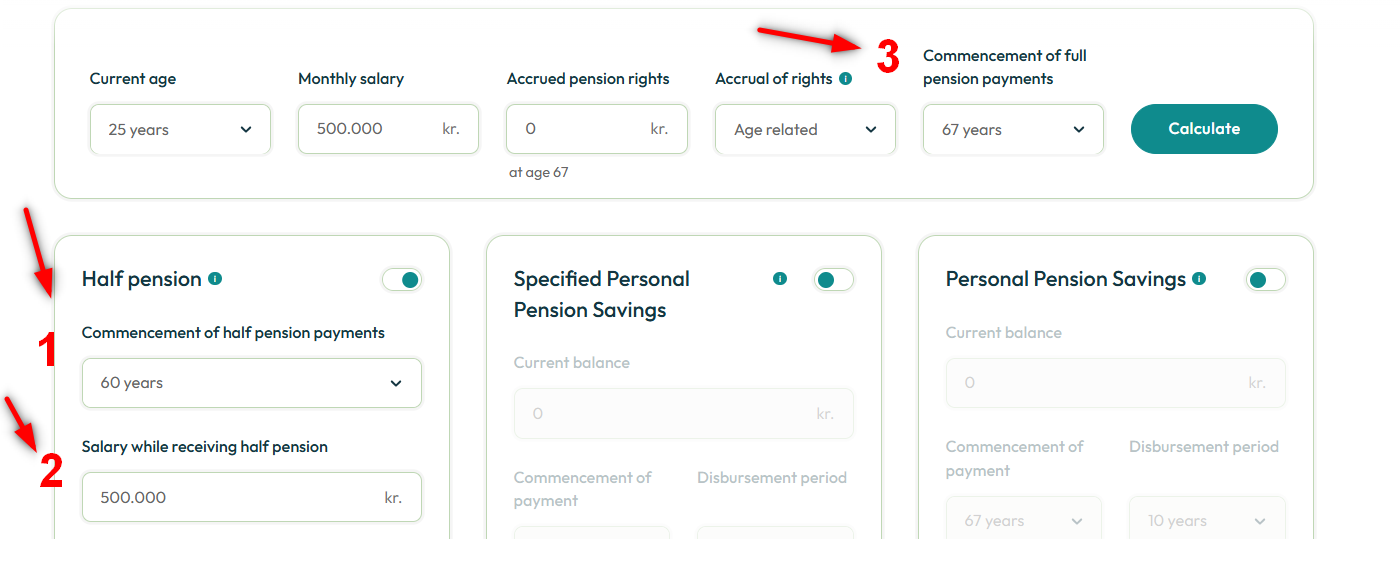

In the calculator, you can now activate the “Half Pension” option to see how this could look for you. If you’re using the calculator on My Pages, where all your personal data is pre-filled, you only need to select three things:

- When partial pension payments will commence

- The salary you expect to earn while receiving half pension payments

- When you plan to start the commencement of full pension payments

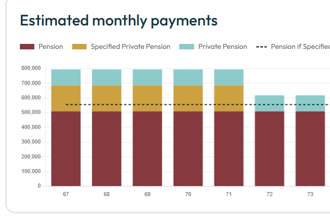

In the results window, you’ll then see the estimated pension payments for the period during which you receive half pensions and the payments after you start receiving full pension.

Continue Working While Receiving Full Pension:

Another option for Division A members is to continue working after starting full pension payments and continue accruing pension rights. At the age of 70, the pension is recalculated based on the contributions made after full retirement began, and the payments are increased accordingly.

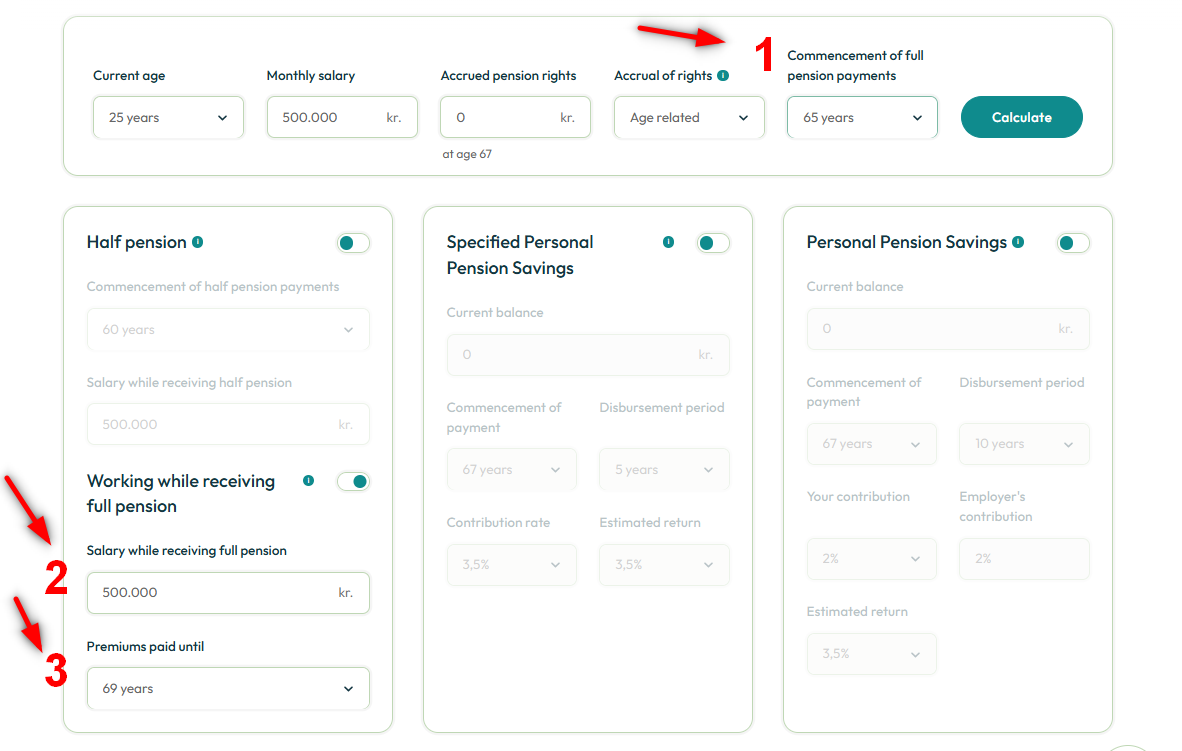

In the calculator, you can now see how this would look for you by activating the “Working While Receiving Full Pension” option. If you’re logged into My Pages, you only need to select three things:

- When full pension payments will commence

- The salary you expect to earn while receiving full pension payments

- How long you plan to continue premium payments (i.e., when you plan to stop working)

In the results window, you’ll see the estimated pension payments for the period after you start receiving full pension and the payments after the recalculation at age 70.

Please note that we always recommend using the calculator on My Pages, where details about your age, salary, accrued pension rights, type of entitlement accrual, and private pension balances are all pre-filled. However, you can also use the calculator without logging in, but in that case, all this information must be entered manually.

Also, keep in mind that for now, the calculator can only provide results for those who have not yet started receiving pension payments or partial pensions from the fund. If you are already receiving half or full pensions from the fund, the calculator cannot display future entitlements.