News and announcements

LSR's 2024 Sustainability Report Published

2. July 2025

LSR has now published its first sustainability report, which provides a detailed overview of the fund’s sustainability activities in 2024. The report covers both the fund’s investment portfolio and internal operations.

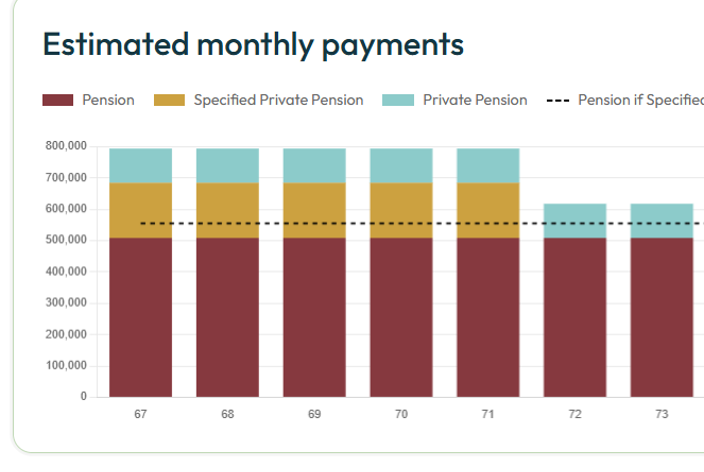

More Powerful Pension Calculator

12. May 2025

LSR’s pension calculator for Division A has been updated, allowing fund members to now calculate the impact of taking half-pension benefits before transitioning to full pension. Members can also see how their pension entitlements develop if they choose to continue working while receiving full pension payments.

LSR Annual Report 2024 Now Published

6. May 2025

The LSR Annual Report for 2024 has now been released. It covers the fund’s operations over the past year, year-end assets, and much more. This year’s report comes in a new format, with an emphasis on interactive presentation of content and information.

LSR Annual Meeting to Be Held on May 6

22. April 2025

The LSR Annual Meeting will take place at 3:00 PM on Tuesday, May 6. Please note that this year’s meeting will be held at a different location than in previous years: Hotel Reykjavík Natura, Nauthólsvegur 52. The meeting is open to all fund members and employers.